virginia tesla tax credit

Theres good news on the local front on electric vehicle tax incentives and rebates in Virginia. This tax credit can be utilized in conjunction with any rebates or incentive programs available.

Joe Biden To Face Push Back On Ev Rules At First Three Amigos Summit In 5 Years Car News

You can claim a credit for up to 350 new jobs.

. 1 There is a 25 fee for the. You get a 7500 tax. The reason is that once a car manufacturer sells its 200000th.

The legislation will be introduced when the Virginia General Assembly convenes on January 13 2021. With one of these special plates EVs may access HOV lanes until 2025. A 500 income tax credit for each new green job created.

And it says Enhanced Rebate for Qualified Resident of the Commonwealth which is defined in the header at someone who makes less than 300 of the poverty line. Refer to Virginia Code 581-2250 for specifics. Reid D-32nd would have granted a state-tax rebate of up to 3500.

Below that and its just 100 or so. HB 1979 proposes that an individual who buys. 11th 2021 622 am PT.

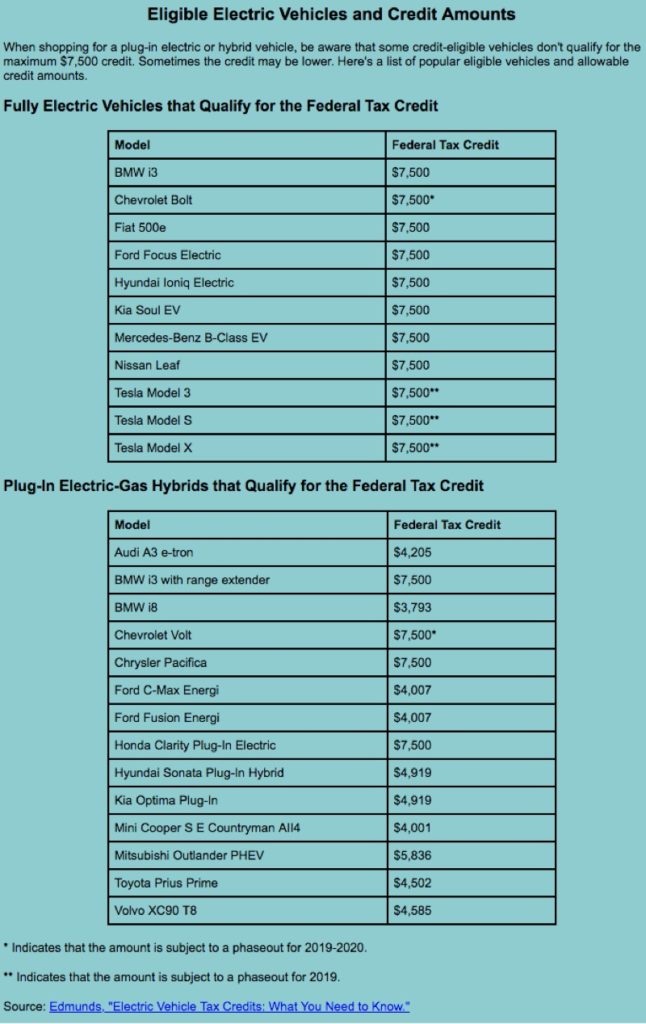

With the Investment Tax Credit ITC you can reduce the cost of your PV solar energy system by 26 percent. Local Virginia and Maryland Electric Vehicle Tax Credits and Rebates. Depending on the vehicle you plan to purchase or currently own there are several federal tax credits that may apply to your situation.

1500 tax credit for lease of a new vehicle. The state offers special clean vehicle license plates available for electric cars. The legislation will be introduced when the Virginia General Assembly convenes on January 13 2021.

If the battery capacity is over 40 Kwh then theres an additional 3500 tax credit p. You claim the credit the same year that you create the job then each of the next 4. Based on your EVs battery capacity and gross weight.

To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page. It sounds like if approved the bill would give a 10 State tax credit up to 3500 on the purchase of a BEV not a plug-in Hybrid effective January 1st 2018 for the next 5 years. If the vehicle meets that definition theres a 4000 base tax credit p.

Reid D-32nd would have granted a state-tax rebate of up to 3500 to buyers of plug-in electric cars. If you keep your car for a long time youll eventually get there in 5-6 years. This credit may range from 2500 to 7500 and is intended to make it more affordable to manage the up-front costs of these vehicles.

Dont forget about federal solar incentives. Federal Tax Incentives for Buying a Fuel-Efficient Car. The credit amount will vary based on the capacity of the battery used to power the vehicle.

Beginning January 1 2022 a resident of the Commonwealth who purchases a new electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500. Review the credits below to see what you may be able to deduct from the tax you owe. However you should be aware of the following.

The federal solar tax credit. My car tax bill this year got car in May was 924 for my Model 3 LR RWD. A qualified resident of the Commonwealth who purchases such vehicle shall also be eligible for an additional 2000 enhanced rebate.

Tesla cars bought after May 24 2021 would be retroactively eligible for a 7500 tax credit on 2021 tax returns. You may notice something surprisingtheres no way to get an EV tax credit in 2022 for a Tesla or GM EV. A bill proposed in mid-January by Virginia House Delegate David A.

In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability. The federal tax credit falls to 22 at the end of 2022. Tesla cars bought after December 31 2021 would be eligible for.

2500 tax credit for purchase of a new vehicle. A qualified resident of the. Select utilities may offer a solar incentive filed on behalf of the customer.

Tesla to get access to. Tesla to get access to 7000 tax credit on 400000 more electric cars in the US with new incentive reform. Virginia Governor Ralph Northam has signed a bill which will require car manufacturers to sell a certain percentage of electric or hybrid vehicles.

This incentive covers 30 of the cost with a maximum credit of up to 1000. To entice American taxpayers to go green the government offers numerous federal tax. Used Vehicles Would Qualify.

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Virginia State And Federal Tax Credits For Electric Vehicles In Chantilly Va Pohanka Lexus

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green Ameriestate

Electric Car Tax Credits What S Available Energysage

Virginia State And Federal Tax Credits For Electric Vehicles In Chantilly Va Pohanka Lexus

Tax Credit For Electric Cars Tax Credits Online Taxes Irs Taxes

Federal Ev Tax Credit Phaseout Quarter For Tesla Becoming More Clear Sort Of Cleantechnica

Are Ev Tax Credits Back On The Table Maybe E E News

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green Ameriestate

Federal Ev Tax Credit Phaseout Quarter For Tesla Becoming More Clear Sort Of Cleantechnica

Super Shock Tesla Owner In China Receives Over 600 000 Supercharging Bill Electric Vehicles News

Electric Cars For Sale In San Francisco Ca Cargurus

Elon Musk Slams Biden S Agenda Dismisses Ev Tax Credits E E News

Federal Ev Tax Credit Phaseout Quarter For Tesla Becoming More Clear Sort Of Cleantechnica

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Opinion Elon Musk S Diatribe Against Subsidies Ignores The History Of The Tech Industry The Washington Post

Local Virginia And Maryland Electric Vehicle Tax Credits And Rebates Easterns